Financial Data Access Regulation (FiDA) - What can insurance companies and the like expect?

The Financial Data Access Regulation (FiDA) is one of the central elements of the European Union's Digital Finance Strategy. As part of the European digital strategy, FiDA supports the transition to open finance and promotes a data-driven approach in the financial sector. It creates a new framework that standardizes, expands and secures access to financial data.

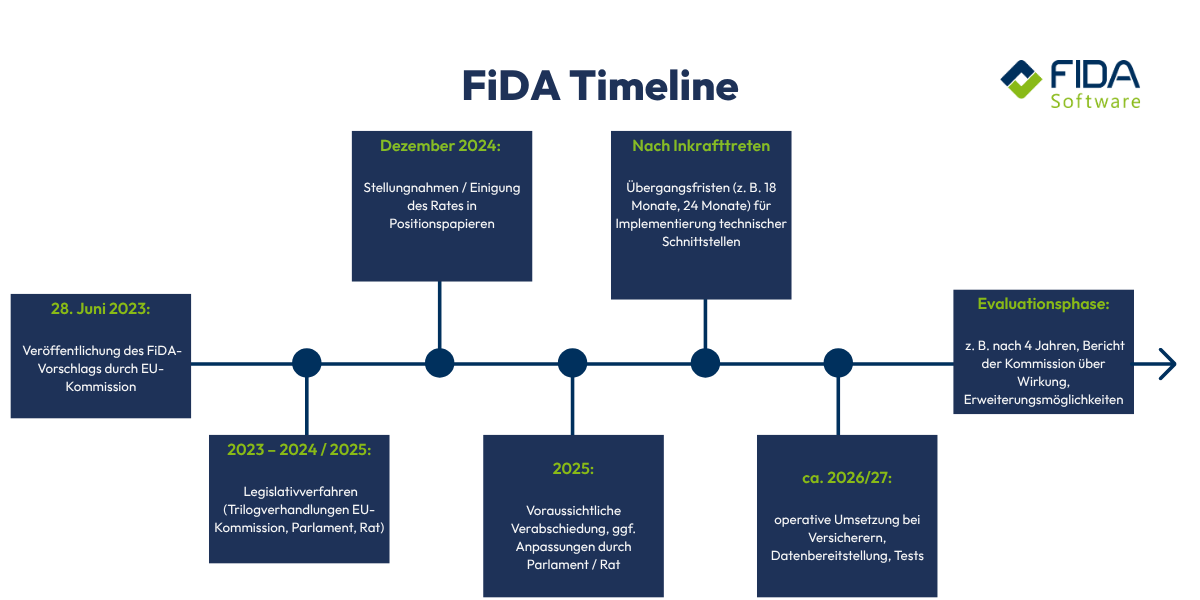

The new regulation is expected to come into force from 2027. It is likely to change the market noticeably - possibly even leading to a market shakeout. Smaller financial service providers in particular face the challenge of implementing the extensive technical and regulatory requirements. Comparison portals and data-driven platform providers, on the other hand, could benefit from the new framework conditions and further expand their role in the financial sector. It should be particularly emphasized that FiDA also involves the insurance industry and thus enables access to insurance data in the open financial ecosystem.

Its aim is to place the controlled exchange of data between banks, insurance companies, financial service providers and authorized third-party providers on a common, transparent basis.

In future, authorized third-party providers will be able to access financial data (always with the customer's consent) and thus offer innovative, tailored services. The introduction of FiDA therefore represents a milestone for the European financial sector.

But what exactly is behind the FiDA and what challenges will insurance companies and financial service providers face?

What is behind the Financial Data Access Regulation?

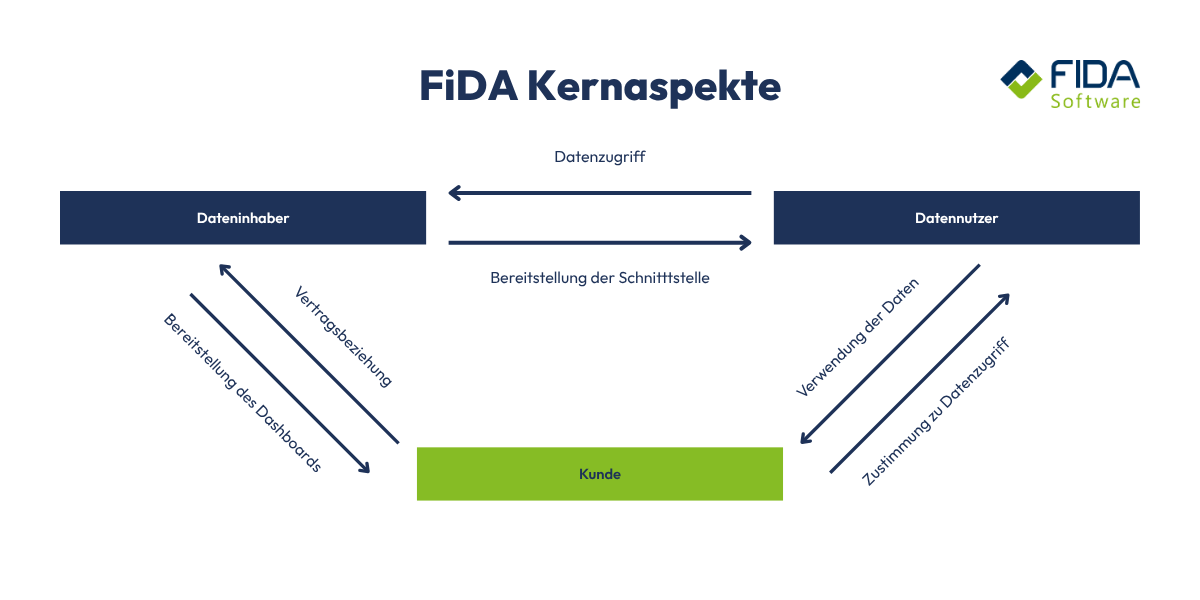

The FiDA regulates the exchange of financial data between data owners (e.g. banks or insurers) and data users (e.g. FinTechs or other companies). It goes well beyond the previous open banking model and affects the entire financial sector. The aim is to promote transparency, innovation and competition in Europe.

What role does the European Union play?

With the Financial Data Access Regulation (FiDA), the European Union is playing a central role in shaping digital finance. The FiDA is a key EU initiative aimed at driving innovation and regulatory change in the financial sector. Its aim is to create a single European data space for financial information in which transparency, security and innovation are guaranteed in equal measure. The EU sees FiDA as a decisive step towards strengthening the single market, leveling the playing field and securing Europe's digital sovereignty in the financial sector.

The close dovetailing with existing regulations - such as the Data Act, PSD2 and the Digital Operational Resilience Act (DORA) - will create a coherent regulatory foundation that enables the exchange of data across national borders. The FiDA contributes significantly to the creation of a uniform legal framework that regulates access to financial data and the exchange of data within the European financial industry. In this way, the EU is not only ensuring legal harmonization, but also the technological integration of the European financial market.

For insurance companies and financial service providers, this means that compliance with European standards is the key to sustainable competitiveness. Companies that respond to EU requirements at an early stage can position themselves as trustworthy and future-proof players in an increasingly networked financial ecosystem.

Open Finance: the next step after Open Banking

While Open Banking regulated access to accounts and payment data, Open Finance extends this approach to the entire financial sector. The development is moving in the direction of comprehensively transforming the European financial data market and driving forward the transition from Open Banking to Open Finance. This means that insurance, investments, loans and crypto-assets will also become part of an open digital financial ecosystem in the future.

Data access will be extended to a variety of products, financial products and financial products, including loans, as part of Open Finance, with lenders playing a central role alongside banks. The Financial Data Access (FiDA) Regulation obliges banks and other data holders to share financial data with third parties such as FinTechs and other service providers to enable the use of this data for innovative business models. These changes hold enormous potential for the financial industry, the financial sector and the market by creating new competitive opportunities and having a lasting impact on the market environment.

This development opens up new opportunities - but also brings with it considerable challenges in terms of data security, governance and IT implementation.

The objectives of the FiDA at a glance

With the Financial Data Access Regulation (FiDA), the European Union is pursuing the goal of connecting the European financial market more closely, promoting innovation and ensuring the secure handling of financial data.

It is based on the vision of an open, transparent and fair digital financial ecosystem in which customer data can be shared in a controlled manner and used efficiently.

At its core, the FiDA pursues four central objectives - each of which has far-reaching implications for insurance companies and financial service providers:

Objective 1: Standardized and secure data access

For the first time, the FiDA creates a binding framework for the exchange of sensitive financial data. Financial data sharing schemes play a central role in this by defining technical standards and security requirements for the standardized and secure exchange of data between data owners and data users. In future, data owners - i.e. banks, insurance companies or other financial institutions - will have to provide standardized interfaces (APIs) through which authorized third parties can access data securely and transparently.

As part of the FiDA, various products, in particular financial products and financial products such as loans, investment and pension products, will be made accessible in a standardized manner, with lenders also being included in the regulatory framework. The focus is on data exchange with third parties and the use of financial data to enable innovative business models and personalized services.

For companies, this means

Building interoperable IT systems,

harmonization of different data sources,

and investing in encryption and authentication processes.

The goal: uniform, secure data access across Europe that enables innovation without jeopardizing data protection and information security.

Goal 2: Strengthening customer rights and data sovereignty

A central concern of FiDA is to put control over financial data back into the hands of customers. The use of this data by various players, such as banks, insurance companies and payment service providers, will be clearly regulated. In future, customers will decide for themselves who may access their data, for what purpose and for how long.

Under the FiDA Regulation, third parties, so-called data users, such as fintechs and other service providers, will be able to access and use relevant financial data with the customer's consent. This enables innovative products and services while at the same time safeguarding customers' rights.

This creates:

more transparency in the use of data,

more trust in digital financial services,

and a new basis for customer-centric business models.

For insurance companies and financial service providers, this means that customer consent and consent management will become an integral part of IT and compliance processes.

Objective 3: Promoting innovation and new business models

The FiDA is intended to stimulate competition in the European financial sector and promote innovation in a targeted manner. The potential of the Financial Data Access Regulation (FiDA) lies in particular in enabling innovative business models and driving forward the development of new products and financial products. This also includes financial products such as loans, where lenders can create new offers through standardized data access. Company-related data exchange and the effective use of financial data are facilitated by FiDA, which promotes cross-border cooperation and data-driven innovation in the financial sector. The changes brought about by FiDA in the financial industry and the financial sector as a whole will open up new opportunities for banks, insurance companies, FinTechs and other players.

Controlled access to financial data creates new opportunities for data-based products, such as

personalized insurance offers,

integrated financial platforms,

or AI-supported risk and investment analyses.

Companies that use data intelligently can develop value-added services that improve the customer experience while ensuring regulatory certainty.

Goal 4: Harmonization of regulations within the EU

Until now, regulations on data exchange in the financial sector have been highly fragmented. For the first time, the FiDA provides a uniform legal framework and clear responsibilities in all EU member states. This initiative represents a significant milestone in European financial regulation and is a central component of the European digital strategy to promote open finance. An official guide supports financial institutions and other stakeholders in implementing the new requirements.

For insurance companies operating across Europe, this simplifies the integration of data flows and the development of pan-European products.

What can insurers expect from the FiDA Regulation?

Insurers are also at the center of the FiDA Regulation. For them, the new regulation means a paradigm shift: away from closed, proprietary systems and towards open data access models.

This opens up the insurance sector more to the controlled exchange of data with banks, FinTechs and other market participants.

This opening creates a wide range of opportunities:

Better risk assessment through access to external financial data,

Development of data-based and personalized products,

more efficient processes through automated data exchange,

and new cooperation models within the open finance ecosystem.

At the same time, FiDA also entails clear obligations. Insurers must invest in modern IT infrastructures, security solutions and governance structures in order to meet the regulatory requirements.

In particular, the development of standardized interfaces (APIs) and effective consent management are key prerequisites for operating in compliance with FiDA.

This makes FiDA a double lever for insurance companies: a regulatory issue on the one hand and a driver of innovation on the other.

Those who act early can use the new framework conditions to differentiate themselves from the competition and establish customer-oriented, data-driven business models.

Implementing the FiDA: from strategy to practice

The implementation of the Financial Data Access Regulation (FiDA) is not a purely technical project - it is a strategic transformation that affects governance, processes, IT and compliance in equal measure.

For insurance companies and financial service providers, this means that existing systems, data structures and organizational models must be adapted to the new regulatory requirements in several clearly defined steps.

These steps include the development of a digital strategy and the implementation of targeted initiatives in order to exploit the full potential of the FiDA.

1. strategic preparation

A clear FiDA roadmap is needed before the technical implementation begins. This should answer the following questions:

What types of data are affected by FiDA?

Which systems currently manage this data?

Which interfaces need to be opened or adapted?

Which internal processes and roles are involved?

On this basis, an implementation plan can be developed that integrates regulatory, technical and organizational aspects.

FIDA tip: An early gap analysis helps to identify existing gaps between the current status and FiDA requirements - and to avoid additional costs later on.

2 Technical implementation: interfaces and data architecture

A core element of FiDA is the development of standardized interfaces (APIs). Companies must ensure that they can provide data in a standardized, machine-readable format.

This applies in particular to

the connection of legacy systems (legacy IT),

the integration of new API standards,

and the establishment of security mechanisms (e.g. encryption, authentication, access management).

Many insurers are faced with the challenge of harmonizing heterogeneous system landscapes.

This is where middleware solutions and data governance frameworks can help to establish FiDA-compliant data exchange processes without having to redevelop the entire IT ecosystem.

3 Compliance and governance

The FiDA requires not only technical but also organizational measures. Companies must document who accesses which data and when, and ensure that customers can actively manage and revoke their consent.

In concrete terms, this means

Setting up a consent management system,

defining clear responsibilities in data management,

and implementing ongoing compliance monitoring.

FIDA tip: Close dovetailing of IT and compliance can prevent regulation from becoming a brake on innovation.

4. pilot phase and gradual rollout

The FiDA will be introduced in stages across Europe. Companies should use the time until it comes into force to test their systems, interfaces and processes in pilot projects.

Successful pilots make it possible

identify technical risks at an early stage,

address training needs among employees,

and to validate regulatory processes in a realistic manner.

A subsequent rollout in waves (e.g. by product line or customer segment) reduces implementation risks and facilitates integration into ongoing operations.

Successful implementation of FiDA - with FIDA as a partner

Implementing the Financial Data Access Regulation (FiDA) requires more than just technical adjustments. It is a comprehensive transformation project that combines IT, regulation, governance and strategy.

Insurance companies and financial service providers in particular are faced with the challenge of integrating complex regulatory requirements into existing IT landscapes without jeopardizing ongoing operations.

This is where we at FIDA come into play. As an experienced IT consulting partner in the finance and insurance sector, we accompany you along the entire path to FiDA compliance - from analysis and implementation to ongoing operations.

Our services at a glance:

Strategic consulting: We analyze which data, systems and processes are affected by the FiDA and develop an individual roadmap for your company.

Technical implementation: Our experts provide support with the connection of interfaces (APIs), the harmonization of data architectures and the integration of security mechanisms.

Governance and compliance: We help you to establish clear responsibilities, consent management and compliance with all regulatory requirements.

Change management and training: We support teams with knowledge transfer in order to anchor FiDA requirements in the company in the long term.

Long-term support: Even after implementation, we provide support with audits, reporting and continuous optimization of data processes.

With our expertise, we combine regulation, technology and practice - so that FiDA becomes a strategic opportunity for you rather than an obligation. We make your organization future-proof and FiDA-ready so that you can exploit competitive advantages at an early stage.

FAQ - Frequently asked questions about the FiDA Regulation

FiDA is an EU regulation as part of the Digital Finance Strategy that regulates standardized, secure and transparent access to financial data between banks, insurers, FinTechs and other players. It extends the concept of open banking to open finance and covers the entire financial sector.

FiDA is expected to apply from 2027. It affects all companies in the financial sector, including banks, insurance companies, lenders, platform providers and third-party providers that work with financial data.

Secure and standardized data access via APIs

Strengthening customer rights and data sovereignty (who can access data when and how)

Promoting innovation and new data-based business models

Harmonization of regulations in the EU to reduce fragmented processes and different standards

Insurance companies have to adapt to several changes:

Development and maintenance of standardized interfaces for data provision

Integration of external financial data for better risk assessment and product development

Investment in IT infrastructure, security and governance

Introduction of effective consent and access management

Harmonization of existing IT systems and data sources

Provision of APIs in standardized and machine-readable formats

Security technologies such as encryption, authentication and access control

Dealing with legacy systems (legacy IT) and integrating them into the new setting

Establishment of a consent management system to control access rights by customers

Clear roles and responsibilities in data management and governance

ongoing compliance monitoring and documentation of who accesses which data and when

internal strategies and processes to meet regulatory requirements in the long term

Development of personalized products through an expanded database

More efficient processes through automated data exchange and use of external data sources

New collaborations in open finance ecosystems

Competitive advantages if companies react early and strategically to FiDA

Carrying out a gap analysis to identify existing gaps

Development of a FiDA roadmap with technical, legal and organizational steps

Pilot projects and gradual rollout to identify risks early on and make adjustments

Training employees and integrating the requirements into current processes

Technical complexity when integrating and harmonizing different systems

Data protection and security risks, especially for sensitive data and access by third parties

Effort and costs for implementation, compliance, governance and training

Organizational adjustments, especially for companies with a heterogeneous system landscape

Companies that plan early, establish suitable technical and organizational structures and see FiDA not just as an obligation but as a potential for innovation can achieve competitive advantages, develop new business models and position themselves as trustworthy partners in the open financial ecosystem.